Global Herbicides Market Overview:

As per a report by Food and Agriculture Organization of the United Nations, in the recent preceding years, arable land has augmented universally by only 155 million hectare or 11 percent of about 1.5 billion hectare recorded between 1960-1990[1]. Such scarcity of arable land creates a demand for efficient farming practices, utilizing every section of the farming plot, thereby propelling demand in the herbicides market. Herbicides are known as weed killers and are chemical pesticides employed by the robustly growing and rapidly innovating agricultural sector to check unwanted floras adversely affecting the production of desired crop. Selective herbicides demolishes a specific weed species, with desired crop relatively left unharmed, on the other hand non-selective herbicides are applied to clear waste ground, industrial and construction sites, railway embankments as they execute all the plant materials coming in contact. As per the IndustryARC business intelligence report, the global herbicides market size was around $30 billion in 2018, and the market demand is projected to grow at a notable CAGR of around 8% during the forecast period of 2019 to 2025.

Global Herbicides Market Outlook:

After an acute analysis of the application segments, it is noted that herbicides find immense scope of application in several industries such as agriculture, landscaping and forestry. Swift and epidemic progression in the usage of organic herbicides in variety of crops such as rye, buckwheat, and oilseed radish is driving the herbicides market’s agricultural application segment. Keeping the soil healthy is an important aspect of weed control, which is highly possible using organic herbicides. Herbicides also prevents soil erosion as well as water loss. Owing to such circumstances, the analyst in this research report has stated the agriculture sector to be the chief employer of herbicides market with demands from this sector growing at a CAGR of around 5% going through 2025.

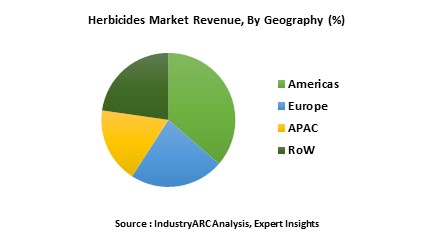

Herbicides have a global demand but APAC is the fastest growing regional market with a global CAGR of more than 40% which is mainly attributed to the impeccable agricultural lands and number of consumers in India and China. FICCI (Federation of Indian Chambers of Commerce & Industry) stated that Indian agriculture sector contributes approximately 14% to India’s GDP[2]. And Organisation for Economic Co-operation and Development revealed that China has 21% of global population in its territory along with 9% of universal arable land[3].

Global Herbicides Market Growth Drivers and Recent Trends:

In the recent years, the world has witnessed unprecedented demand from the robustly growing F&B sector owing to rapidly increasing world population. Traditional farming techniques are time consuming and less economical in terms of labor costs, and global reduction in farming lands further adds to the dilemma. To combat and deliver under such crucial circumstances, employment of efficient farming commodities such as herbicides by agricultural sector is inevitable

Increasing trend of tourism has fashioned a global demand for well ornamented and aesthetically feasible landscape, which is a growing factor affecting the global herbicides market. Herbicides plays a vital role in maintaining grass lands free from broad leaf vegetation. Herbicides are applied to conserve park and farms. It is also finds application in golf courses to keep it away from undesired grass or plants. Herbicides are used in forest to attain the preferred yield of large trees and constraining the cultivation of undesired plant.

Global Herbicides Market Challenges:

The application of inorganic herbicides is beset with the substantial ecological hazards. For example, some herbicides have adverse effects on the aquatic organisms and their excessive contact may cause health problems to farmers. This has instigated the ban if herbicides by numerous regional regulations. Example- The use of phenoxy herbicides is restricted in Western Australia (WA) under the Aerial Spraying Control Act 1966 and the Agriculture and Related Resources Protection (Spraying Restrictions) Regulation 1979.

However, with the initiation of bio-based products the herbicides market has witnessed significant profitable avenues. Additionally, the persistent research and development on studying the biochemical feat of herbicides on plants has controlled the chemicals with better toxicity profile.

Global Herbicides Market Players Perspective:

Some of the major key players profiled in this business intelligence report are BASF, Bayer AG, DOW Agriscience LLC and Syngenta AG.

In May 2017, Syngenta AG, Syngenta AG is a Swiss-based global company that produces agrochemicals and seeds, entered the wheat herbicides market with its new Talinor cereals herbicides. The company recorded sales of $12.65 billion in 2017. This will be the first time when Syngenta AG will be entering into herbicides market and according to them, this will revolutionize the herbicide market as well. Well, the participation of such global giants in the herbicides market surely displays the caliber of this arcade to accommodate hefty returns.

Herbicides Market Research Scope:

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Herbicides Market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the types of products in the Herbicides Market, and their specific applications in different phases of operations.

Herbicides Market Report: Industry Coverage

By Selectivity: Selective and Non selective

By Industry: Agriculture, Landscaping, Golf course, Forestry

By molecular nature: Organic and Inorganic

The Herbicides Market report also analyzes the major geographic regions for the market as well as the major countries for the market in these regions. The regions and countries covered in the study include:

North America: The U.S., Canada, Mexico

South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

Europe: The U.K., Germany, Italy, France, The Netherlands, Belgium, Spain, Denmark

APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

Middle East and Africa: Israel, South Africa, Saudi Arabia

Key Questions Addressed in the Herbicides Market Report

1. Is the market for Herbicides growing? How long will it continue to grow and at what rate?

2. Which type of Herbicides presents the major growth opportunities?

3. Is there a possibility for change in the market structure over time?

4. Are additional developments needed for the existing product or services offerings or do the existing products meet the customer demands?

5. Do the key vendors look for partnerships to expand their businesses with respect to geography or product?

6. What is the current status of Herbicides application in different countries?

7. Which are the major relevant product segments within Herbicides?

8. Which type of segment will witness heavy adoption in the near future?

9. What are the short-term, long-term, and medium-term growth drivers for the market?

10. What are the short-term, medium-term, and long-term challenges for the market?

11. What are the short-term, medium-term, and long-term opportunities for the market

12. Who are the top players/companies of the market?

13. What are the recent innovations in the market?

14. How many patents have been filed by the leading players?

15. What are the types of patents filed by the leading players?

16. What is the futuristic scenario for the adoption of Herbicides?

17. What is our Vision 2030 Herbicides Market?

A few focus points of this Research are given below:

- Give a deep-dive analysis of the key operational strategies with focus on the corporate structure, R&D strategies, localization strategies, production capabilities, and sales performance of various companies

- Provide an overview of the product portfolio, including product planning, development, and positioning

- Discuss the role of technology companies in partnerships

- Explore the regional sales activities

- Analyze the market size and giving the forecast for current and future herbicides during the forecast 2018–2023

- Analyze the competitive factors, competitors’ market shares, product capabilities, and supply chain structures

IndustryARC Research Best Practices

The Herbicides Market size is evaluated based on the number of products per organization type along with the varying price points pertaining to specific applications. These were identified as key informational conjectures for market estimation in 2017/2018.

The Herbicides Market share is thoroughly checked against all data points that have been incorporated and rechecked against various data sources. Various C-level executives and key opinion leaders are contacted for verification of the data.

The Herbicides Market forecast and growth rate are achieved by applying the time series forecasting methodology on the various factors. The market forecast and growth rate are further backed with historical trends of the market along with a regressive mathematical model that assesses the value based on factors such as capital expenditure, equipment lifespan, R&D investments, and so on.

The Herbicides Market demand has been researched taking into account the prominent economies across the different geographic regions to understand their corresponding impact on the market.

The Herbicides Market drivers are evaluated for short-term, medium-term, and long-term based on the different market dynamics impacting the market.

The Herbicides Market challenges are evaluated for short-term, medium-term, and long-term based on the different market dynamics impacting the market.

The Herbicides Market trends have been analyzed taking into consideration the micro and macro trends prevalent in various geographies.

The Herbicides Market outlook provides a brief overview of the market performance and anticipated change in market dynamics.

The Herbicides Market analysis also involves the identification of new companies that have entered the market scenario and their impact on the market dynamics in the future.

1. Herbicides Market - Overview

1.1. Definitions and Scope

2. Herbicides Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Herbicides Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Herbicides Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Herbicides Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Herbicides Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Herbicides Market -Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Herbicides Market – By Selectivity (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Selective Herbicide

8.3.2. Non-selective Herbicide

9. Herbicides Market – By Time of action (Market Size -$Million / $Billion)

9.1. Pre plant

9.2. Pre-emergence

9.3. Post-emergence

10. Herbicides Market – By method of application (Market Size -$Million / $Billion)

10.1. Foliar

10.2. Soil

11. Herbicides Market – By mode of action (Market Size -$Million / $Billion)

11.1. Contact Herbicides

11.2. Trans located (systemic ) herbicide

12. Herbicides Market – By Molecular nature (Market Size -$Million / $Billion)

12.1. Organic Herbicide

12.1.1. Oils

12.1.2. Aliphatic

12.1.3. Amides

12.1.4. Benzoic

12.1.5. Carbamate

12.1.6. Thocarbamate

12.1.7. Dithiocarbamate

12.1.8. Bipyridylium

12.1.9. Nitralins

12.1.10. Urea

12.1.11. Uracil

12.1.12. Diphenyl Ether

12.1.13. Ditroanilines

12.1.14. Phenoxy

12.1.15. Triazines

12.1.16. Organic Arsenicals

12.1.17. Others

12.2. Inorganic Herbicide

12.2.1. Acids

12.2.2. Salts

13. Herbicides Market – By Formulation (Market Size -$Million / $Billion)

13.1. Emulsifiable concentrate

13.2. Wettable powders

13.3. Granules

13.4. Water Soluble Concentrate

14. Herbicides Market – By inhibitors (Market Size -$Million / $Billion)

14.1. Lipid synthesis inhibitor

14.2. Amino acid synthesis Inhibitors

14.3. Growth regulators

14.4. Photosynthesis Inhibitor

14.5. Nitrogen metabolism inhibitor

14.6. Pigment inhibitor

14.7. Cell membrane disrupter

14.8. Seedling root growth inhibitor

14.9. Others

15. Herbicides Market – By application (Market Size -$Million / $Billion)

15.1. Agriculture

15.2. Landscaping

15.3. Golf course

15.4. Forestry

15.5. Others

16. Herbicides - By Geography (Market Size -$Million / $Billion)

16.1. Herbicides Market - North America Segment Research

16.2. North America Market Research (Million / $Billion)

16.2.1. Segment type Size and Market Size Analysis

16.2.2. Revenue and Trends

16.2.3. Application Revenue and Trends by type of Application

16.2.4. Company Revenue and Product Analysis

16.2.5. North America Product type and Application Market Size

16.2.5.1. U.S.

16.2.5.2. Canada

16.2.5.3. Mexico

16.2.5.4. Rest of North America

16.3. Herbicides - South America Segment Research

16.4. South America Market Research (Market Size -$Million / $Billion)

16.4.1. Segment type Size and Market Size Analysis

16.4.2. Revenue and Trends

16.4.3. Application Revenue and Trends by type of Application

16.4.4. Company Revenue and Product Analysis

16.4.5. South America Product type and Application Market Size

16.4.5.1. Brazil

16.4.5.2. Venezuela

16.4.5.3. Argentina

16.4.5.4. Ecuador

16.4.5.5. Peru

16.4.5.6. Colombia

16.4.5.7. Costa Rica

16.4.5.8. Rest of South America

16.5. Herbicides - Europe Segment Research

16.6. Europe Market Research (Market Size -$Million / $Billion)

16.6.1. Segment type Size and Market Size Analysis

16.6.2. Revenue and Trends

16.6.3. Application Revenue and Trends by type of Application

16.6.4. Company Revenue and Product Analysis

16.6.5. Europe Segment Product type and Application Market Size

16.6.5.1. U.K

16.6.5.2. Germany

16.6.5.3. Italy

16.6.5.4. France

16.6.5.5. Netherlands

16.6.5.6. Belgium

16.6.5.7. Spain

16.6.5.8. Denmark

16.6.5.9. Rest of Europe

16.7. Herbicides – APAC Segment Research

16.8. APAC Market Research (Market Size -$Million / $Billion)

16.8.1. Segment type Size and Market Size Analysis

16.8.2. Revenue and Trends

16.8.3. Application Revenue and Trends by type of Application

16.8.4. Company Revenue and Product Analysis

16.8.5. APAC Segment – Product type and Application Market Size

16.8.5.1. China

16.8.5.2. Australia

16.8.5.3. Japan

16.8.5.4. South Korea

16.8.5.5. India

16.8.5.6. Taiwan

16.8.5.7. Malaysia

17. Herbicides Market - Entropy

17.1. New product launches

17.2. M&A's, collaborations, JVs and partnerships

18. Herbicides Market – Industry / Segment Competition landscape Premium

18.1. Market Share Analysis

18.1.1. Market Share by Country- Top companies

18.1.2. Market Share by Region- Top 10 companies

18.1.3. Market Share by type of Application – Top 10 companies

18.1.4. Market Share by type of Product / Product category- Top 10 companies

18.1.5. Market Share at global level- Top 10 companies

18.1.6. Best Practises for companies

19. Herbicides Market – Key Company List by Country Premium

20. Herbicides Market Company Analysis

20.1. Market Share, Company Revenue, Products, M&A, Developments

20.2. Bayer

20.3. Syngenta

20.4. BASF

20.5. DOW Agro sciences

20.6. Monsanto

20.7. Company 6

20.8. Company 7

20.9. Company 8

20.10. Company 9

20.11. Company 10 and More

"*Financials would be provided on a best efforts basis for private companies"

21. Herbicides Market -Appendix

21.1. Abbreviations

21.2. Sources

22. Herbicides Market -Methodology Premium

22.1. Research Methodology

22.1.1. Company Expert Interviews

22.1.2. Industry Databases

22.1.3. Associations

22.1.4. Company News

22.1.5. Company Annual Reports

22.1.6. Application Trends

22.1.7. New Products and Product database

22.1.8. Company Transcripts

22.1.9. R&D Trends

22.1.10. Key Opinion Leaders Interviews

22.1.11. Supply and Demand Trends

List of Tables:

Table 1: Herbicides Market Overview 2021-2026

Table 2: Herbicides Market Leader Analysis 2018-2019 (US$)

Table 3: Herbicides Market Product Analysis 2018-2019 (US$)

Table 4: Herbicides Market End User Analysis 2018-2019 (US$)

Table 5: Herbicides Market Patent Analysis 2013-2018* (US$)

Table 6: Herbicides Market Financial Analysis 2018-2019 (US$)

Table 7: Herbicides Market Driver Analysis 2018-2019 (US$)

Table 8: Herbicides Market Challenges Analysis 2018-2019 (US$)

Table 9: Herbicides Market Constraint Analysis 2018-2019 (US$)

Table 10: Herbicides Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Herbicides Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Herbicides Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Herbicides Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Herbicides Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Herbicides Market Value Chain Analysis 2018-2019 (US$)

Table 16: Herbicides Market Pricing Analysis 2021-2026 (US$)

Table 17: Herbicides Market Opportunities Analysis 2021-2026 (US$)

Table 18: Herbicides Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Herbicides Market Supplier Analysis 2018-2019 (US$)

Table 20: Herbicides Market Distributor Analysis 2018-2019 (US$)

Table 21: Herbicides Market Trend Analysis 2018-2019 (US$)

Table 22: Herbicides Market Size 2018 (US$)

Table 23: Herbicides Market Forecast Analysis 2021-2026 (US$)

Table 24: Herbicides Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26: Herbicides Market By Type, Revenue & Volume, By Synthetic Herbicides, 2021-2026 ($)

Table 27: Herbicides Market By Type, Revenue & Volume, By Bio-Herbicides, 2021-2026 ($)

Table 28: Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 29: Herbicides Market By Crop Type, Revenue & Volume, By Cereals & Grains, 2021-2026 ($)

Table 30: Herbicides Market By Crop Type, Revenue & Volume, By Oil seeds & Pulses, 2021-2026 ($)

Table 31: Herbicides Market By Crop Type, Revenue & Volume, By Fruits & VegeTable s, 2021-2026 ($)

Table 32: Herbicides Market By Crop Type, Revenue & Volume, By Cotton, 2021-2026 ($)

Table 33: Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 34: Herbicides Market By Crop Based, Revenue & Volume, By Turf & Ornamentals based, 2021-2026 ($)

Table 35: Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 36: Herbicides Market By Method Of Application, Revenue & Volume, By Foilage- Active Herbicides, 2021-2026 ($)

Table 37: Herbicides Market By Method Of Application, Revenue & Volume, By Soil- Active Herbicides, 2021-2026 ($)

Table 38: Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 39: Herbicides Market By Mode Of Action, Revenue & Volume, By Selective Herbicides, 2021-2026 ($)

Table 40: Herbicides Market By Mode Of Action, Revenue & Volume, By Non-Selective Herbicides, 2021-2026 ($)

Table 41: North America Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 42: North America Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 43: North America Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 44: North America Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 45: North America Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 46: South america Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 47: South america Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 48: South america Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 49: South america Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 50: South america Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 51: Europe Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 52: Europe Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 53: Europe Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 54: Europe Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 55: Europe Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 56: APAC Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 57: APAC Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 58: APAC Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 59: APAC Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 60: APAC Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 61: Middle East & Africa Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 62: Middle East & Africa Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 63: Middle East & Africa Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 64: Middle East & Africa Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 65: Middle East & Africa Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 66: Russia Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 67: Russia Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 68: Russia Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 69: Russia Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 70: Russia Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 71: Israel Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 72: Israel Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 73: Israel Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 74: Israel Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 75: Israel Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 76: Top Companies 2018 (US$) Herbicides Market, Revenue & Volume

Table 77: Product Launch 2018-2019 Herbicides Market, Revenue & Volume

Table 78: Mergers & Acquistions 2018-2019 Herbicides Market, Revenue & Volume

List of Figures:

Figure 1: Overview of Herbicides Market 2021-2026

Figure 2: Market Share Analysis for Herbicides Market 2018 (US$)

Figure 3: Product Comparison in Herbicides Market 2018-2019 (US$)

Figure 4: End User Profile for Herbicides Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Herbicides Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Herbicides Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Herbicides Market 2018-2019

Figure 8: Ecosystem Analysis in Herbicides Market 2018

Figure 9: Average Selling Price in Herbicides Market 2021-2026

Figure 10: Top Opportunites in Herbicides Market 2018-2019

Figure 11: Market Life Cycle Analysis in Herbicides Market

Figure 12: GlobalBy Type Herbicides Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy Crop Type Herbicides Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy Crop Based Herbicides Market Revenue, 2021-2026 ($)

Figure 15: GlobalBy Method Of Application Herbicides Market Revenue, 2021-2026 ($)

Figure 16: GlobalBy Mode Of Action Herbicides Market Revenue, 2021-2026 ($)

Figure 17: Global Herbicides Market - By Geography

Figure 18: Global Herbicides Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19: Global Herbicides Market CAGR, By Geography, 2021-2026 (%)

Figure 20: North America Herbicides Market Value & Volume, 2021-2026 ($)

Figure 21: US Herbicides Market Value & Volume, 2021-2026 ($)

Figure 22: US GDP and Population, 2018-2019 ($)

Figure 23: US GDP – Composition of 2018, By Sector of Origin

Figure 24: US Export and Import Value & Volume, 2018-2019 ($)

Figure 25: Canada Herbicides Market Value & Volume, 2021-2026 ($)

Figure 26: Canada GDP and Population, 2018-2019 ($)

Figure 27: Canada GDP – Composition of 2018, By Sector of Origin

Figure 28: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29: Mexico Herbicides Market Value & Volume, 2021-2026 ($)

Figure 30: Mexico GDP and Population, 2018-2019 ($)

Figure 31: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33: South America Herbicides Market Value & Volume, 2021-2026 ($)

Figure 34: Brazil Herbicides Market Value & Volume, 2021-2026 ($)

Figure 35: Brazil GDP and Population, 2018-2019 ($)

Figure 36: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38: Venezuela Herbicides Market Value & Volume, 2021-2026 ($)

Figure 39: Venezuela GDP and Population, 2018-2019 ($)

Figure 40: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42: Argentina Herbicides Market Value & Volume, 2021-2026 ($)

Figure 43: Argentina GDP and Population, 2018-2019 ($)

Figure 44: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46: Ecuador Herbicides Market Value & Volume, 2021-2026 ($)

Figure 47: Ecuador GDP and Population, 2018-2019 ($)

Figure 48: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50: Peru Herbicides Market Value & Volume, 2021-2026 ($)

Figure 51: Peru GDP and Population, 2018-2019 ($)

Figure 52: Peru GDP – Composition of 2018, By Sector of Origin

Figure 53: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54: Colombia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 55: Colombia GDP and Population, 2018-2019 ($)

Figure 56: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58: Costa Rica Herbicides Market Value & Volume, 2021-2026 ($)

Figure 59: Costa Rica GDP and Population, 2018-2019 ($)

Figure 60: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62: Europe Herbicides Market Value & Volume, 2021-2026 ($)

Figure 63: U.K Herbicides Market Value & Volume, 2021-2026 ($)

Figure 64: U.K GDP and Population, 2018-2019 ($)

Figure 65: U.K GDP – Composition of 2018, By Sector of Origin

Figure 66: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67: Germany Herbicides Market Value & Volume, 2021-2026 ($)

Figure 68: Germany GDP and Population, 2018-2019 ($)

Figure 69: Germany GDP – Composition of 2018, By Sector of Origin

Figure 70: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71: Italy Herbicides Market Value & Volume, 2021-2026 ($)

Figure 72: Italy GDP and Population, 2018-2019 ($)

Figure 73: Italy GDP – Composition of 2018, By Sector of Origin

Figure 74: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75: France Herbicides Market Value & Volume, 2021-2026 ($)

Figure 76: France GDP and Population, 2018-2019 ($)

Figure 77: France GDP – Composition of 2018, By Sector of Origin

Figure 78: France Export and Import Value & Volume, 2018-2019 ($)

Figure 79: Netherlands Herbicides Market Value & Volume, 2021-2026 ($)

Figure 80: Netherlands GDP and Population, 2018-2019 ($)

Figure 81: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83: Belgium Herbicides Market Value & Volume, 2021-2026 ($)

Figure 84: Belgium GDP and Population, 2018-2019 ($)

Figure 85: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87: Spain Herbicides Market Value & Volume, 2021-2026 ($)

Figure 88: Spain GDP and Population, 2018-2019 ($)

Figure 89: Spain GDP – Composition of 2018, By Sector of Origin

Figure 90: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91: Denmark Herbicides Market Value & Volume, 2021-2026 ($)

Figure 92: Denmark GDP and Population, 2018-2019 ($)

Figure 93: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95: APAC Herbicides Market Value & Volume, 2021-2026 ($)

Figure 96: China Herbicides Market Value & Volume, 2021-2026

Figure 97: China GDP and Population, 2018-2019 ($)

Figure 98: China GDP – Composition of 2018, By Sector of Origin

Figure 99: China Export and Import Value & Volume, 2018-2019 ($) Herbicides Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100: Australia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 101: Australia GDP and Population, 2018-2019 ($)

Figure 102: Australia GDP – Composition of 2018, By Sector of Origin

Figure 103: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104: South Korea Herbicides Market Value & Volume, 2021-2026 ($)

Figure 105: South Korea GDP and Population, 2018-2019 ($)

Figure 106: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108: India Herbicides Market Value & Volume, 2021-2026 ($)

Figure 109: India GDP and Population, 2018-2019 ($)

Figure 110: India GDP – Composition of 2018, By Sector of Origin

Figure 111: India Export and Import Value & Volume, 2018-2019 ($)

Figure 112: Taiwan Herbicides Market Value & Volume, 2021-2026 ($)

Figure 113: Taiwan GDP and Population, 2018-2019 ($)

Figure 114: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116: Malaysia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 117: Malaysia GDP and Population, 2018-2019 ($)

Figure 118: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120: Hong Kong Herbicides Market Value & Volume, 2021-2026 ($)

Figure 121: Hong Kong GDP and Population, 2018-2019 ($)

Figure 122: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124: Middle East & Africa Herbicides Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125: Russia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 126: Russia GDP and Population, 2018-2019 ($)

Figure 127: Russia GDP – Composition of 2018, By Sector of Origin

Figure 128: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129: Israel Herbicides Market Value & Volume, 2021-2026 ($)

Figure 130: Israel GDP and Population, 2018-2019 ($)

Figure 131: Israel GDP – Composition of 2018, By Sector of Origin

Figure 132: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133: Entropy Share, By Strategies, 2018-2019* (%) Herbicides Market

Figure 134: Developments, 2018-2019* Herbicides Market

Figure 135: Company 1 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 136: Company 1 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137: Company 1 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 138: Company 2 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 139: Company 2 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140: Company 2 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 141: Company 3 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 142: Company 3 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143: Company 3 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 144: Company 4 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 145: Company 4 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146: Company 4 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 147: Company 5 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 148: Company 5 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149: Company 5 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 150: Company 6 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 151: Company 6 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152: Company 6 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 153: Company 7 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 154: Company 7 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155: Company 7 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 156: Company 8 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 157: Company 8 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158: Company 8 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 159: Company 9 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 160: Company 9 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161: Company 9 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 162: Company 10 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 163: Company 10 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164: Company 10 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 165: Company 11 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 166: Company 11 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167: Company 11 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 168: Company 12 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 169: Company 12 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170: Company 12 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 171: Company 13 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 172: Company 13 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173: Company 13 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 174: Company 14 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 175: Company 14 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176: Company 14 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 177: Company 15 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 178: Company 15 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179: Company 15 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Table 1: Herbicides Market Overview 2021-2026

Table 2: Herbicides Market Leader Analysis 2018-2019 (US$)

Table 3: Herbicides Market Product Analysis 2018-2019 (US$)

Table 4: Herbicides Market End User Analysis 2018-2019 (US$)

Table 5: Herbicides Market Patent Analysis 2013-2018* (US$)

Table 6: Herbicides Market Financial Analysis 2018-2019 (US$)

Table 7: Herbicides Market Driver Analysis 2018-2019 (US$)

Table 8: Herbicides Market Challenges Analysis 2018-2019 (US$)

Table 9: Herbicides Market Constraint Analysis 2018-2019 (US$)

Table 10: Herbicides Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Herbicides Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Herbicides Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Herbicides Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Herbicides Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Herbicides Market Value Chain Analysis 2018-2019 (US$)

Table 16: Herbicides Market Pricing Analysis 2021-2026 (US$)

Table 17: Herbicides Market Opportunities Analysis 2021-2026 (US$)

Table 18: Herbicides Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Herbicides Market Supplier Analysis 2018-2019 (US$)

Table 20: Herbicides Market Distributor Analysis 2018-2019 (US$)

Table 21: Herbicides Market Trend Analysis 2018-2019 (US$)

Table 22: Herbicides Market Size 2018 (US$)

Table 23: Herbicides Market Forecast Analysis 2021-2026 (US$)

Table 24: Herbicides Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26: Herbicides Market By Type, Revenue & Volume, By Synthetic Herbicides, 2021-2026 ($)

Table 27: Herbicides Market By Type, Revenue & Volume, By Bio-Herbicides, 2021-2026 ($)

Table 28: Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 29: Herbicides Market By Crop Type, Revenue & Volume, By Cereals & Grains, 2021-2026 ($)

Table 30: Herbicides Market By Crop Type, Revenue & Volume, By Oil seeds & Pulses, 2021-2026 ($)

Table 31: Herbicides Market By Crop Type, Revenue & Volume, By Fruits & VegeTable s, 2021-2026 ($)

Table 32: Herbicides Market By Crop Type, Revenue & Volume, By Cotton, 2021-2026 ($)

Table 33: Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 34: Herbicides Market By Crop Based, Revenue & Volume, By Turf & Ornamentals based, 2021-2026 ($)

Table 35: Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 36: Herbicides Market By Method Of Application, Revenue & Volume, By Foilage- Active Herbicides, 2021-2026 ($)

Table 37: Herbicides Market By Method Of Application, Revenue & Volume, By Soil- Active Herbicides, 2021-2026 ($)

Table 38: Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 39: Herbicides Market By Mode Of Action, Revenue & Volume, By Selective Herbicides, 2021-2026 ($)

Table 40: Herbicides Market By Mode Of Action, Revenue & Volume, By Non-Selective Herbicides, 2021-2026 ($)

Table 41: North America Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 42: North America Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 43: North America Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 44: North America Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 45: North America Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 46: South america Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 47: South america Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 48: South america Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 49: South america Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 50: South america Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 51: Europe Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 52: Europe Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 53: Europe Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 54: Europe Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 55: Europe Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 56: APAC Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 57: APAC Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 58: APAC Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 59: APAC Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 60: APAC Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 61: Middle East & Africa Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 62: Middle East & Africa Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 63: Middle East & Africa Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 64: Middle East & Africa Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 65: Middle East & Africa Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 66: Russia Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 67: Russia Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 68: Russia Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 69: Russia Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 70: Russia Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 71: Israel Herbicides Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 72: Israel Herbicides Market, Revenue & Volume, By Crop Type, 2021-2026 ($)

Table 73: Israel Herbicides Market, Revenue & Volume, By Crop Based, 2021-2026 ($)

Table 74: Israel Herbicides Market, Revenue & Volume, By Method Of Application, 2021-2026 ($)

Table 75: Israel Herbicides Market, Revenue & Volume, By Mode Of Action, 2021-2026 ($)

Table 76: Top Companies 2018 (US$) Herbicides Market, Revenue & Volume

Table 77: Product Launch 2018-2019 Herbicides Market, Revenue & Volume

Table 78: Mergers & Acquistions 2018-2019 Herbicides Market, Revenue & Volume

List of Figures:

Figure 1: Overview of Herbicides Market 2021-2026

Figure 2: Market Share Analysis for Herbicides Market 2018 (US$)

Figure 3: Product Comparison in Herbicides Market 2018-2019 (US$)

Figure 4: End User Profile for Herbicides Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Herbicides Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Herbicides Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Herbicides Market 2018-2019

Figure 8: Ecosystem Analysis in Herbicides Market 2018

Figure 9: Average Selling Price in Herbicides Market 2021-2026

Figure 10: Top Opportunites in Herbicides Market 2018-2019

Figure 11: Market Life Cycle Analysis in Herbicides Market

Figure 12: GlobalBy Type Herbicides Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy Crop Type Herbicides Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy Crop Based Herbicides Market Revenue, 2021-2026 ($)

Figure 15: GlobalBy Method Of Application Herbicides Market Revenue, 2021-2026 ($)

Figure 16: GlobalBy Mode Of Action Herbicides Market Revenue, 2021-2026 ($)

Figure 17: Global Herbicides Market - By Geography

Figure 18: Global Herbicides Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19: Global Herbicides Market CAGR, By Geography, 2021-2026 (%)

Figure 20: North America Herbicides Market Value & Volume, 2021-2026 ($)

Figure 21: US Herbicides Market Value & Volume, 2021-2026 ($)

Figure 22: US GDP and Population, 2018-2019 ($)

Figure 23: US GDP – Composition of 2018, By Sector of Origin

Figure 24: US Export and Import Value & Volume, 2018-2019 ($)

Figure 25: Canada Herbicides Market Value & Volume, 2021-2026 ($)

Figure 26: Canada GDP and Population, 2018-2019 ($)

Figure 27: Canada GDP – Composition of 2018, By Sector of Origin

Figure 28: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29: Mexico Herbicides Market Value & Volume, 2021-2026 ($)

Figure 30: Mexico GDP and Population, 2018-2019 ($)

Figure 31: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33: South America Herbicides Market Value & Volume, 2021-2026 ($)

Figure 34: Brazil Herbicides Market Value & Volume, 2021-2026 ($)

Figure 35: Brazil GDP and Population, 2018-2019 ($)

Figure 36: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38: Venezuela Herbicides Market Value & Volume, 2021-2026 ($)

Figure 39: Venezuela GDP and Population, 2018-2019 ($)

Figure 40: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42: Argentina Herbicides Market Value & Volume, 2021-2026 ($)

Figure 43: Argentina GDP and Population, 2018-2019 ($)

Figure 44: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46: Ecuador Herbicides Market Value & Volume, 2021-2026 ($)

Figure 47: Ecuador GDP and Population, 2018-2019 ($)

Figure 48: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50: Peru Herbicides Market Value & Volume, 2021-2026 ($)

Figure 51: Peru GDP and Population, 2018-2019 ($)

Figure 52: Peru GDP – Composition of 2018, By Sector of Origin

Figure 53: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54: Colombia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 55: Colombia GDP and Population, 2018-2019 ($)

Figure 56: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58: Costa Rica Herbicides Market Value & Volume, 2021-2026 ($)

Figure 59: Costa Rica GDP and Population, 2018-2019 ($)

Figure 60: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62: Europe Herbicides Market Value & Volume, 2021-2026 ($)

Figure 63: U.K Herbicides Market Value & Volume, 2021-2026 ($)

Figure 64: U.K GDP and Population, 2018-2019 ($)

Figure 65: U.K GDP – Composition of 2018, By Sector of Origin

Figure 66: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67: Germany Herbicides Market Value & Volume, 2021-2026 ($)

Figure 68: Germany GDP and Population, 2018-2019 ($)

Figure 69: Germany GDP – Composition of 2018, By Sector of Origin

Figure 70: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71: Italy Herbicides Market Value & Volume, 2021-2026 ($)

Figure 72: Italy GDP and Population, 2018-2019 ($)

Figure 73: Italy GDP – Composition of 2018, By Sector of Origin

Figure 74: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75: France Herbicides Market Value & Volume, 2021-2026 ($)

Figure 76: France GDP and Population, 2018-2019 ($)

Figure 77: France GDP – Composition of 2018, By Sector of Origin

Figure 78: France Export and Import Value & Volume, 2018-2019 ($)

Figure 79: Netherlands Herbicides Market Value & Volume, 2021-2026 ($)

Figure 80: Netherlands GDP and Population, 2018-2019 ($)

Figure 81: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83: Belgium Herbicides Market Value & Volume, 2021-2026 ($)

Figure 84: Belgium GDP and Population, 2018-2019 ($)

Figure 85: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87: Spain Herbicides Market Value & Volume, 2021-2026 ($)

Figure 88: Spain GDP and Population, 2018-2019 ($)

Figure 89: Spain GDP – Composition of 2018, By Sector of Origin

Figure 90: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91: Denmark Herbicides Market Value & Volume, 2021-2026 ($)

Figure 92: Denmark GDP and Population, 2018-2019 ($)

Figure 93: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95: APAC Herbicides Market Value & Volume, 2021-2026 ($)

Figure 96: China Herbicides Market Value & Volume, 2021-2026

Figure 97: China GDP and Population, 2018-2019 ($)

Figure 98: China GDP – Composition of 2018, By Sector of Origin

Figure 99: China Export and Import Value & Volume, 2018-2019 ($) Herbicides Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100: Australia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 101: Australia GDP and Population, 2018-2019 ($)

Figure 102: Australia GDP – Composition of 2018, By Sector of Origin

Figure 103: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104: South Korea Herbicides Market Value & Volume, 2021-2026 ($)

Figure 105: South Korea GDP and Population, 2018-2019 ($)

Figure 106: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108: India Herbicides Market Value & Volume, 2021-2026 ($)

Figure 109: India GDP and Population, 2018-2019 ($)

Figure 110: India GDP – Composition of 2018, By Sector of Origin

Figure 111: India Export and Import Value & Volume, 2018-2019 ($)

Figure 112: Taiwan Herbicides Market Value & Volume, 2021-2026 ($)

Figure 113: Taiwan GDP and Population, 2018-2019 ($)

Figure 114: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116: Malaysia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 117: Malaysia GDP and Population, 2018-2019 ($)

Figure 118: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120: Hong Kong Herbicides Market Value & Volume, 2021-2026 ($)

Figure 121: Hong Kong GDP and Population, 2018-2019 ($)

Figure 122: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124: Middle East & Africa Herbicides Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125: Russia Herbicides Market Value & Volume, 2021-2026 ($)

Figure 126: Russia GDP and Population, 2018-2019 ($)

Figure 127: Russia GDP – Composition of 2018, By Sector of Origin

Figure 128: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129: Israel Herbicides Market Value & Volume, 2021-2026 ($)

Figure 130: Israel GDP and Population, 2018-2019 ($)

Figure 131: Israel GDP – Composition of 2018, By Sector of Origin

Figure 132: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133: Entropy Share, By Strategies, 2018-2019* (%) Herbicides Market

Figure 134: Developments, 2018-2019* Herbicides Market

Figure 135: Company 1 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 136: Company 1 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137: Company 1 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 138: Company 2 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 139: Company 2 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140: Company 2 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 141: Company 3 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 142: Company 3 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143: Company 3 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 144: Company 4 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 145: Company 4 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146: Company 4 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 147: Company 5 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 148: Company 5 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149: Company 5 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 150: Company 6 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 151: Company 6 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152: Company 6 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 153: Company 7 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 154: Company 7 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155: Company 7 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 156: Company 8 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 157: Company 8 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158: Company 8 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 159: Company 9 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 160: Company 9 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161: Company 9 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 162: Company 10 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 163: Company 10 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164: Company 10 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 165: Company 11 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 166: Company 11 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167: Company 11 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 168: Company 12 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 169: Company 12 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170: Company 12 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 171: Company 13 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 172: Company 13 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173: Company 13 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 174: Company 14 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 175: Company 14 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176: Company 14 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Figure 177: Company 15 Herbicides Market Net Revenue, By Years, 2018-2019* ($)

Figure 178: Company 15 Herbicides Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179: Company 15 Herbicides Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print